“No one saw this coming", Nobody predicted the crisis: this is a common claim. However, Dirk Bezemer, at Groningen University, tells us that it is not true, and names twelve economists, most of them outsiders, that foresaw the financial turmoil and the recession. Nobody listened to them: they were too unconventional.

One has to add to this group of good forecaster the Bank of International Settlement’s (BIS) economists that have also a good theory about the causes of the disaster. And it would be bizarre to argue that central bankers did not notice the warnings from the BIS, one of the most powerful international organizations: its annual reports are approved by 56 central banks in the world. Nevertheless, they likely shrugged off its warnings.

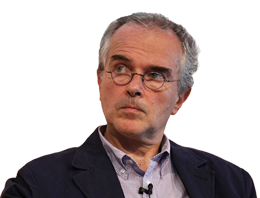

They did the same thing in 2005 at the Jackson Hole Symposium organized by the Federal Reserve of Kansas City. In that occasion Raghuram Rajan, then Director of Research at the International Monetary Fund, and today a professor at the Chicago University and author with Luigi Zingales of “Saving Capitalism from the Capitalists, warned central bankers, policymakers and economists: “We should be prepared for the low probability but highly costly downturn. In such an eventuality, it is possible the losses that emanate from a financial catastrophe cannot be entirely borne by current generations and are best shared with future generations” he said in his speech “Has Financial Development Made the World Riskier?”. Rajan was worried by the “perverse behavior” of many managers, driven by wrong incentives and a low interest rates environment. He advocated a more mindful monetary policy and a better supervision.

Almost nobody, in the audience, agreed with Rajan: not Lawrence Summers, now Director of the White House’s National Economic Council; nor Stanley Fischer, governor of the Bank of Israel. Axel Weber, candidate at the presidency of the European Central Bank (ECB), said to Rajan: “Work a bit on that”. Donald Kohn, now vice chairman of the Federal Reserve, praised the “Greenspan doctrine”, welcomed the same evolution of financial markets that alarmed Rajan, and concluded “remainders to the public of the inherent uncertainty in economic developments and policy responses are appropriate and should have some effects”. Jean Claude Trichet, president at the ECB, simply recognized that there was too little transparency in the financial system. Only Alan Blinder, an open-minded economist and a former vice-president at Federal reserve, defended Rajan.

The question is: why so much deafness? Are policymakers too prone to ideology? Do we lack appropriate accountability rules for central bankers? Is monetary policy unable to handle the financial instability? The world needs an answer.